Jin**n Fertility Group Limited has always been highly regarded by market investors as a stock featured scarcity on the Hong Kong Stock Exchange.

In recent years, however, Jin**n Fertility's performance has been under pressure in the capital market, but from a fundamental perspective, the Group's overall performance is still commendable. In addition, the assisted reproductive industry is facing policy benefits, especially from provinces that have already included assisted reproductive in medical insurance, greatly increasing the business volume of assisted reproductive services (ARS).

So, what are the expected differences in the market behind the lack of resonance between fundamentals and valuation? How should we view the current opportunities in the context of the certainty of favorable industry policies?

1. Profitability continues to rise with sustained operating results

Looking at the mid-term financial report recently submitted by Jin**n Fertility, it can be said that the business situation presented in this semi-annual report is still stable.

According to financial report data, Jin**n Fertility achieved a revenue of RMB 1.44 billion in the first half of the year, a year-on-year increase of 8.2%; Adjusted EBITDA of 418 million yuan, a year-on-year increase of 6.1%; Net profit after adjustment of 260 million yuan, a year-on-year increase of 1.8%.

While the core performance indicators remained stable, the Group's operating cash flow performance was also quite good, which directly demonstrated its impressive endogenous ability to generate revenue. In the first half of the year, its net cash income from operating activities reached 384 million yuan, a year-on-year increase of 14.0%.

In the face of a complex external market environment, the Group continued to maintain a solid financial foundation and optimize its debt structure. Its interest bearing debt ratio decreased to 13.7% for the half year, a year-on-year decrease of 0.6 percentage points.

In terms of domestic and international business, the Group created different development strategies based on the geographical characteristics and development stages of its medical institutions to promote the upward development of domestic and international business.

From a domestic business aspect

For mature institutions, Jin**n Fertility took its Chengdu operations as a paradigm to build a one-stop integrated business with ARS as core services, to support the entire fertility and health management, to better serve patients. The Group strengthened core departments such as reproductive medicine and obstetrics, while further diversified discipline construction to expand business network for better brand awareness with wider customer bases, thereby reserving patients with longer conversion cycles for core businesses.

For incubation institutions, the Group continued to focus on its core ARS business, took stringent measures to improve its quality and safety system, and shifted its operating model to operation-driven from marketing-driven.

From an overseas perspective

As regards US business, the Group continued to anchor the development trend of the assisted reproductive industry in the United States, and constantly strengthened its 36-year brand history and implemented the “physician as partner” mechanism to grant outstanding physicians with equity ownership as partners. The team expansion of medical professionals has also laid a solid foundation for the HRC expansion.

4 new doctors joined the HRC in 2023, and 5 new doctors are expected to join in 2024. The number of reproductive doctors owned by HRC is expected to reach 24 by the end of the year. In the first half of 2024, HRC obtained a year-on-year increase of about 22% in total cycle volume. The integration of new and old doctors not only promoted the increase of HRC business volume, but also provided a reserve of medical talents for HRC's expansion. As of now, HRC Medical holds 4 core clinics and 7 satellite centers in the Los Angeles and San Diego areas of the United States. At the same time, in response to the development trend of egg freezing in the United States, the Group has launched sets of egg freezing medical services to further increase the influence of HRC in the assisted reproductive market in the United States.

Furthermore, outside of the United States, Jin**n Fertility also promoted the development of its overseas business in light of actual conditions based on region-specific approach. Among them, Jinrui Medical Center in Laos has created a "small yet beautiful" self-built operating model with high-efficiency, which has achieved profitability in less than a year of operation, providing a feasible reference model for the Group's expansion in other emerging markets in Southeast Asia.

Also worth mentioning is that in April of this year, the Group signed a contract with Morula, the largest ARS group in Indonesia, becoming its largest strategic investor. Morula has a wide service network in Indonesia, with 10 IVF clinics. Through this cooperation, the Group was able to inject its advantageous resources in medical technology, doctor training, information technology, and customer relationship management into Morula, further improving its service quality and operational efficiency. The first step taken by the Group through strategic investment in Southeast Asia not only helps to deepen its development in the Indonesian market, but also provides valuable experience and models for future strategic expansion in other Southeast Asian countries.

Through innovative operating models, strategic investments, and collaborations, the Group has been gradually building a global ARS network to meet the needs of patients in different regions and promote the sustained growth and international development of the company's business.

2. Driven by Policy & Industry Innovation, Features Certainty & Growth Potential

On the whole, Jin**n Fertility has manifested its high-quality development path to the outside world both in terms of performance and business strategy. In the meantime, the Group is also facing a series of favorable catalysts, which continue to bring new opportunities for development with certainty and high growth.

Firstly, policies are continuously forming a positive driving force for the development of the assisted reproductive industry.

In respect of the domestic market, favorable policies for the industry are being implemented one after another. These certain policies for medical insurance have brought optimistic expectations for the future business development of the Group.

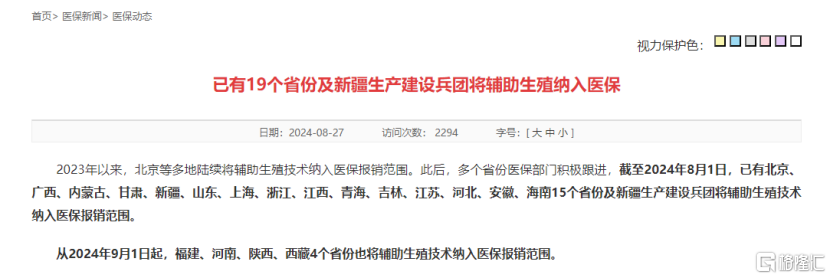

It is worth noting that currently, under the promotion of the National Healthcare Security Administration of China, 19 provinces including Beijing, Guang**, Inner Mongolia, Gansu, and Xinjiang Production and Construction Corps have included assisted reproductive technology in the scope of medical insurance reimbursement. The subsidiary institutions of the Group located in Sichuan, Guangdong, Hubei, and Yunnan have all issued consultation letters related to the inclusion of assisted reproduction in medical insurance reimbursement or pricing, and are expected to be implemented in the near future.

With the implementation of medical insurance policy, the demand for assisted reproduction market is expected to be released, driving a significant increase in the number of infertility patients seeking medical treatment and providing momentum for the sustained growth of the assisted reproduction industry.

来源:国家医保局网站

Source: National Healthcare Security Administration website

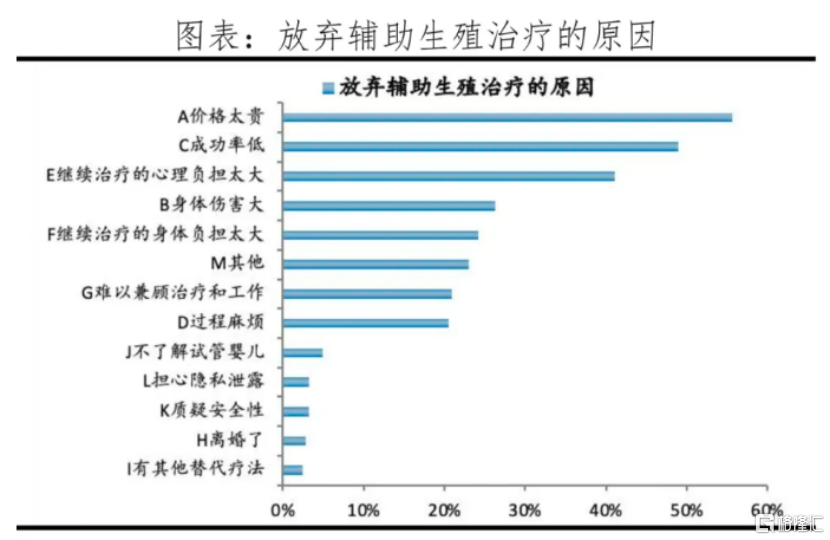

According to the "Assisted Reproduction Research Report in China 2023" released by YuWa Population Research, 55.7% of infertile patients gave up using assisted reproductive treatment due to its high cost. When the subsidy ratio reached 20%, the willingness of potential patients to receive treatment will increase from 71% to over 80%.

(来源:育娲人口:《中国辅助生殖研究报告2023》)

(Source: YuWa Population Research: "Assisted Reproduction Research Report in China 2023")

Moreover, the policy has greatly stimulated the number of assisted reproductive visits based on the regions that have already been included in healthcare insurance. Previously, a person in charge of the medical security bureau of Guang** Zhuang autonomous region responded to an interview with China Youth Daily and mentioned that from the implementation of the policy in November 2023, the outpatient volume of assisted reproductive institutions in the entire autonomous region reached 607700 times, a year-on-year increase of 35.6%.

And when it comes to the US market, the innovation in the assisted reproductive industry is on the rise, and the continuous innovation in the industry has brought greater imaginative room for the future development of HRC.

Sustained driving force has been brought to the development of the industry nowadays no matter what new innovations in products, operating models, or payment methods.

Progyny, who sits at the forefront of American infertility insurance, has driven innovation in payment methods. The company is able to provide reproductive welfare solutions such as IVF for employees of corporate employers, by combining technology, insurance, and medical practice to provide personalized treatments and financial support, which has also established a strong market position in the ARS field.

Further, KindBody, a bellwether in product and operating innovation, provided reproductive health solutions such as IVF and egg freezing through online, offline, and collaborative models. This not only improves service accessibility but also reduces costs through technological means, making advanced reproductive services affordable for more families.

In view of the aforesaid, the active promotion of policies and continuous innovation in the industry have brought tremendous development opportunities for ARS providers such as Jin**n Fertility. The market opportunities in the assisted reproductive industry will still be full of prospects with the release of market demand and the continuous innovation and progress of products, technologies, and service models.

3. Conclusion

The pharma sector receives ongoing optimistic views in performance from institutions on the Hong Kong Stock Exchange as the Federal Reserve enters a interest rate cut cycle nowadays.

The recent research report by CITIC Securities pointed out that it is recommended to focus on the healthcare industry that benefits from the reduction in borrowing costs based on the industry performance during the rate cut cycle. In fact, companies with stable cash flow are more likely to stand out in past interest rate cut cycles, due to their defensive nature and the potential for sustained expansion brought by their solid cash flow.

As a leading ARS provider, Jin**n Fertility has demonstrated in its past financial performance the company's stable cash flow and good business growth capabilities. Through steady expansion both at home and abroad, as well as continuous promotion of innovative businesses, the Group has established a strong brand influence and market competitiveness in the field of ARS.

Meanwhile, the Group has shown a positive side in both management's increase in holdings and repurchases, continuously releasing market confidence.

Significantly, the Group spent HKD 9.57 million to repurchase 4 million shares in the market on August 30th, and it had also spent HKD 21.84 million to repurchase 9 million shares at the end of July.

Through consecutive repurchase actions, it is not difficult to see the Group's confidence in its own value and optimistic expectations for future development prospects.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员