机构:交银国际

ZTE export ban renews focus on China semis: With the US Department of Commerce activating the export ban on ZTE (763 HK/Sell) earlier this week, the market is expecting a bigger push in China to create a self-sufficient semiconductor industry. We believe the push to drive the fabless industry competitiveness should be the focus, and expect the 2nd phase of China IC Fund (as reported by media) to shift its focus toward the fabless segment, as the 1st phase put greater emphasis on capacity expansion (foundry and memory).

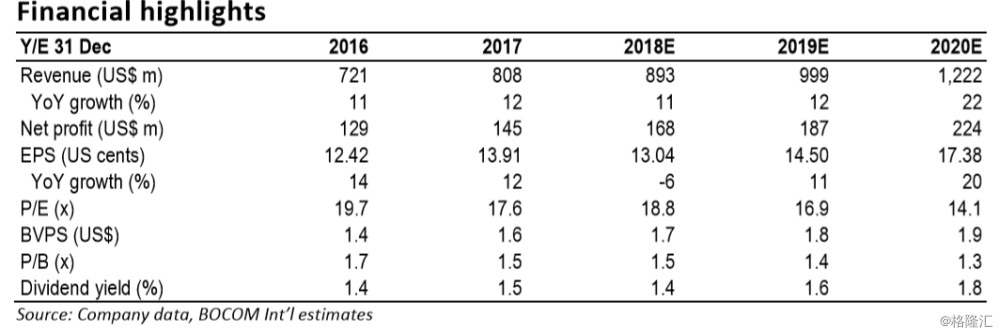

We see Hua Hong as one of the best semis plays in China: We reiterate our positive view on Hua Hong given that: (1) it is a major beneficiary of China’s semis growth (55% of revenue from China fabless); (2) its new capacity in Wuxi (to ramp up in late 2019) will unlock longer-term growth potential; (3) 8” demand outlook is solid with drivers such as smart cards, MCU and PMIC; (4) valuation is attractive; and (5) it has a healthy balance sheet with stable dividends. Compared to both HK-listed and Ashare listed semis names, we believe it is one of the most preferred and less volatile given its stable earnings and prudent approach to growth.

TSMC guidance suggests near-term softness for foundry sector. TSMC (2330 TT) reported 1Q18 results yesterday and guided for 2Q18 revenue to fall 7-8% QoQ citing smartphone weakness and uncertainty over crypto-currency demand (ASIC and GPU). It also lowered its full-year revenue growth estimate to 10% YoY (vs. previous 10-15%). While China smartphone sector is gradually picking up after softness since 4Q17, TSMC cited weakness in the high-end segment (which we believe is Apple related). We believe foundries with 28nm exposure should give subseasonal guidance in 2Q18, while 8” foundries (incl. Hua Hong) should be solid as demand remains healthy.

Valuation remains attractive; reiterate Buy: While the company’s shares rallied 25% over the past two days, valuation remains attractive with shares trading at 1.5x 2018E P/B. On a P/B to ROE basis, we still see its valuation as attractive vs. regional peers, despite having an additional China semis growth driver. We continue to prefer Hua Hong over SMIC (981 HK/Neutral) due to healthier earnings outlook. Our unchanged TP of HK$23 is based on 1.5x 2020E P/B. Reiterate Buy. 。

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员