Rating Hold

Price target - 12mth (HKD) 3.80

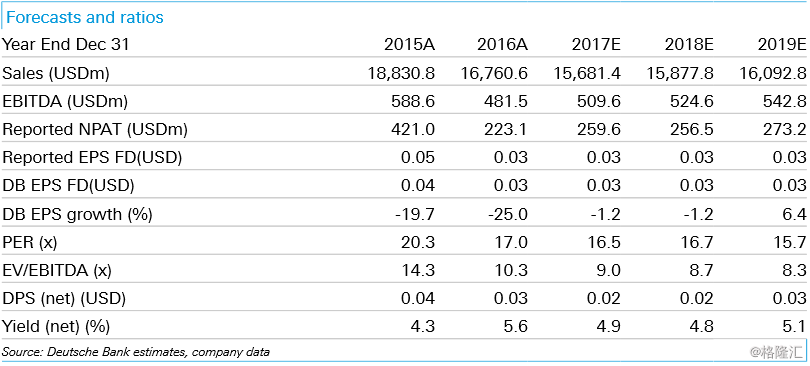

LF announced yesterday that it plans to divest its 3 product verticals, subject to shareholders' approval. We view this positively as the structure of the deal would simplify the operation, improve balance sheet structure and minority shareholders will get a special divided post divestment. Operating outlook for 2018 has improved, according to management, although 2H17 performance will still have some pressure on sales growth. Long term, it needs to roll out its digital supply chain program successfully. Currently, one of the strategies is to improve the adoption rate of its 3D digital printing services which has ~2% adoption rate currently. Maintaining Hold.

Divestment of product verticals: 1) Divestment of three product verticals (namely furniture, beauty and sweaters)

The cash consideration is US$1.1bn and will be sold to Hony Capital, FH1937 (Li & Fung’s parent co) and FIL (Fung Investment Ltd), based on 14.7x EV/ EBIT vs 8-9x EV/EBIT for some of the previous acquisitions that formed the group, according to management.

Post transaction, it will pay a special dividend of USD520m (or HK$0.476/ share).

It also proposes to enter into a connected transaction on services, leasing and logistics and trading services agreement.

A one-time non-cash accounting loss of USD610m will be booked in 2017. Another forex loss (non cash ) might be booked in 2018.

2) Rationale – simplify the business to concentrate its core competencies and offer capital structure flexibility.

3) It needs shareholders’ approval.

The remaining LF – core COP was up by 12% for 1H2017 on a like-for-like basis, which was in line with the 11.9% for the whole group before the divestment.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员