评级:增持

目标价:115港元

Nov-17 shipments below our expectation on customer inventoryadjustment. SunnyOp’s HLS/VLS/HCM shipment volume grew42.9%/19.5%/0.5% YoY respectively in Nov-17. However, on a MoMbasis, HLS/VLS/HCM shipments declined 3.0%/3.9%/10.1% respectively,which was mainly due to customer inventory adjustment. For theJan-Nov 2017 period, shipment growth of HLS/VLS/HCM remained strongat 68.5%/41.8%/23.5% YoY respectively, which suggests that SunnyOphas mostly likely continued to gain domestic market share, in our view.

Lacklustre smartphone shipments in China in a traditionally strongmonth. According to CAICT, China’s YTD (Jan-Nov) smartphone shipmentscontracted by 8.7% YoY (Android camp contracted by 8.3% YoY), whilstshipments in Nov-17 have dropped 21.7% YoY. Traditionally, Nov hasbeen a strong month for smartphone shipments in China, posting42.6%/32.3% MoM growth in Nov-16/Nov-15, which contrasts with anonly 12.7% MoM growth in Nov-17. In our view, growing marketsaturation and lack of innovations in flagship models were to blame forthe sluggish demand. We do not see any major drivers of a pickup inChina’s smartphone shipments in the near-term, which might weigh onthe margins of upstream suppliers.

Still a front-runner in 3D sensing and next generation optics. HuaweiDian Yun Depth Camera’s debut marks another milestone of SunnyOp’spenetration into China 3D sensing supply chain with its modulemanufacturing capability. Though the component is still a plug-insolution, we see SunnyOp could leverage on its miniaturization capabilityto provide embedded solutions in 1H18, which grants SunnyOp ampleroom in the thriving 3D sensing market. In addition, with hybrid lens setsbecoming trendy, SunnyOp is currently in mass production (since Aug-17)of 1G5P hybrid lens using molding glass process. Though we consider theprocess less cost-efficient than WLO/WLG (‘Wafer Level Optics/Glass’),SunnyOp’s extensive experience in glass lens and proven manufacturingcapability (e.g., VLS) bode well for its front-runner position of the nextgeneration optics.

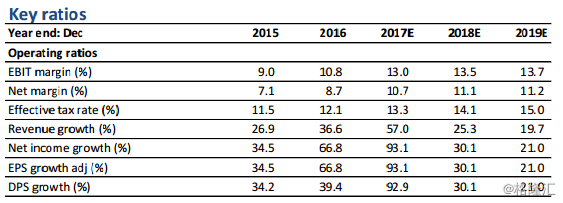

Fair valuation. We have trimmed our FY18E/19E revenue and profitestimates by 4.3%/7.1% and 11.5%/14.5% respectively and lowered ourDCF-based price target to HKD115 (from HKD143), representing FY18E35.1x PER and 11.7x PBR. SunnyOp’s growth potential and technologyadvantage have been reflected in its current valuation. Maintain Hold.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员