What's new

What's new

We expect Logan to generate 40% annual sales growth in 2017/18e on the back of abundant and quality saleable resources in Guangdong-HK-Macau Greater Bay (Bay area), and to keep its balance sheet risks under control amid an ambitious expansion. Given its 30% correction from the September high, we suggest buying into dips.

Comments We expect Rmb40–41bn sales in 2017e (+39%–43% YoY) and another 40% growth in 2018e. 11M17 sales were Rmb38bn and we expect another Rmb2–3bn in December. In 2018e, we believe another 40% sales growth is highly visible given Logan’s abundant and premium saleable resources in Bay area. About Rmb100bn of saleable resources (+43% YoY) in 2018e have been locked in by 4.2mn sqm of GFA new starts in 2017e, among which the Shenzhen region will take a share of 50%.

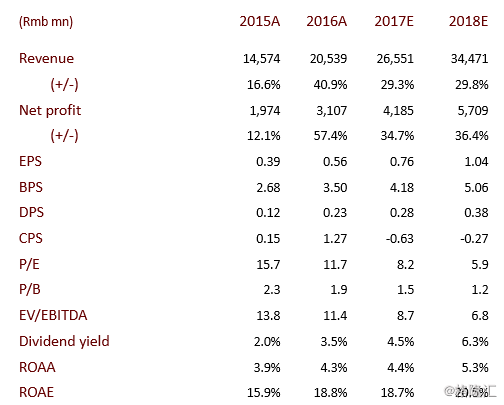

Booked GPM may rise to 33.8%/34.8% in FY17e/18e (+2ppt/1ppt YoY). Sales GPM was 36%–37% YTD and will fuel margin improvement in the coming years. In particular, we expect Shenzhen Carat Complex (“玖钻”, GPM estimated at 40%) to contribute Rmb13bn booked revenue in FY18e, taking up 38% of estimated total revenue.

Balance sheet risks are controllable amid an ambitious expansion; cash flow should stay safe. Logan continued active land purchases (4.9mn sqm replenished vs. 2.2mn sqm sold in 11M17) to enhance its leading position in Bay area and to sustain strong growth for an extended period of time. We expect its net gearing ratio to rise to 122% at end-FY17e (PCS treated as debts) before a visible deleveraging in FY18e (estimated at 110%) thanks to strong sales and earnings. We believe its cash flow will stay safe on strong fundraising capacity, given the 5.9% borrowing cost in 1H17 and >Rmb20bn undrawn bank facilities.

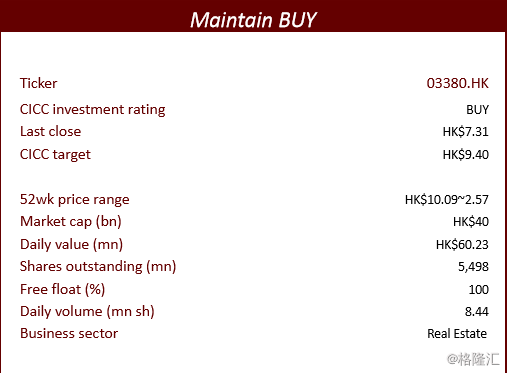

Valuation and recommendation We keep our earnings forecasts unchanged (Rmb42bn/57bn CNP in FY17e/18e, +35%/36% YoY). Maintain BUY and TP at HK$9.40 (29% upside). The stock is now trading at 8.2x/5.9x FY17e/18e P/E (sector average at 10.2x/6.8x) and 45% discount to FY17e NAV.

Risks

Tighter housing policies in Bay area.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员