机构:交银国际

评价:BUY

目标价:147.00 港元

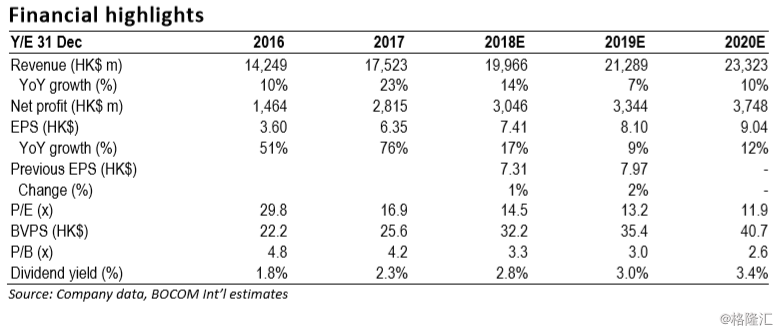

1Q18 results and 2Q18 outlook both ahead of expectations: 1Q18 EPS came in at HK$1.52 (above our estimate of HK$1.47) and revenue came in 5% ahead of our estimate, which offset the softer GPM. The GPM weakness was mainly due to quarter-to-quarter product mix fluctuations, while ASMPT expects GPM to rebound over the coming quarters. More importantly, 1Q18 booking came in ~20% ahead of guidance driven by broad-based strength across SMT, back-end, LED and CIS segments. The company expects 2Q18 revenue to range between US$650m710m (~HK$5.1bn-5.6bn), which is ~10% ahead of our estimate. It also expects booking momentum to continue with 2Q18 booking up by a single-digit percentage YoY.

Positive structural trends against near-term macro uncertainty: While strong 1H18 booking sets the tone for another solid year, visibility remains limited for 2H18 partly due to macro uncertainty, in our view. However, the outlook on many of the company’s mid-to long-term drivers (incl. advanced packaging, memory, mini-LED, industrial/auto demand) remains solid, in our view. The company believes mini-LED has vast longer-term potential, while micro-LED business may focus on small displays (wearable).

Reiterate Buy: We nudge up our 2018/19 EPS estimates by 1%/2% and introduce our 2020 estimates, with our 2018/19/20 EPS estimates at HK$7.41/8.10/9.04 respectively. With another year of healthy growth expected in 2018, we reckon ASMPT’s valuation remains attractive with shares trading at 14.5x/13x 2018/19E P/E (vs. 5-year historical average forward P/E of 20x). While macro outlook remains uncertain, we continue to believe the semiconductor business is becoming less cyclical. Our unchanged TP of HK$147 is based on 20x 2018E P/E. Reiterate Buy.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员