港交所发公告称中国宏桥(01378.HK)已于今天上午10时53分起短暂停止买卖。停牌前报7.15港元,跌8.33%,成交1.36亿港元,最新总市值为519.1亿港元。

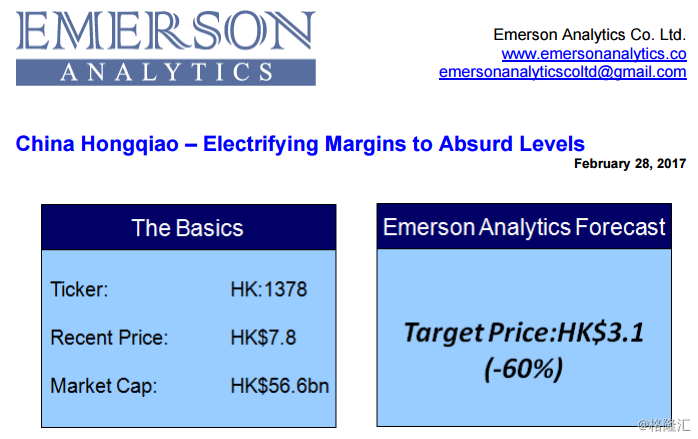

沽空机构Emerson Analytics昨日发表沽空报告,做空中国宏桥(01378.HK),认为其目标价为3.1港元,与目前最新的收盘价7.15港元还有56%的隐性下跌空间。

该机构表示中国宏桥自2011年首次公开发行募集资金52亿元人民币,成为世界上最大的铝生产商。其在IPO阶段开始涉及通过低报生产成本,以极低的价格从关联方购买电力和氧化铝。报告指,于2010年,更夸称录得27.7%净利润率,大幅抛离同业。

该机构经过评估后,认为宏桥实际产电成本应较公司声称的高出40%。自2010年2015年期间,宏桥共少报117亿元人民币的电力生产成本。该行相信,宏桥多年来累计隐瞒了216亿人民币的成本支出。该行更直指,宏桥目标价仅值3.1港元。

事实上,于去年11月23日,宏桥已遭Hongqiao Exposed网站匿名报告指控造假。

下面为Emerson Analytics的做空报告摘要,本编已译成中英对照,个别文字有误之处请见谅。或直接登陆下列外文网站查看亦可:http://www.emersonanalytics.co/downloads/ChinaHongqiao-HK_1378-StrongSell.pdf

China Hongqiao raised Rmb 5.2bn in its 2011 IPO to set itself off on the path to becoming the world's largest aluminum producer. Our investigations show it began cooking its books at the IPO stage by under reporting production costs and purchasing electricity and alumina from connected parties at exceedingly low prices.

中国虹桥2011年首次公开发行募集资金52亿元人民币,成为世界最大铝生产商。 我们的调查显示,它在IPO阶段开始就通过低报生产成本,以超低价格从关联方购买电力和氧化铝。

China Hongqiao's net margins were similar to those of its peers from 2007 to 2009. In 2010, it claimed asharp improvement to a staggering 27.7% when its peers continued to struggle with single-digit margins.In subsequent years, China Hong qiao persisted with its accounting irregularities and reported margins farhigher than those of its peers.

中国虹桥的净利润与2007年至2009年的同业相若。2010年,当其同业继续挣扎单位利润率时,它的利润率达到惊人的27.7%。随后,中国虹桥坚持其会计不规则,报告的利润远远高于其同业。

The company's success is not built on the use of self-supplied electricity as its peers also have captive power plants. We have used three independent methods (working through China Hong qiao's numbers ingreat details, talking to its ex-staff, and relying on data from an industry consultancy) to show that the true cost of its electricity generation is 40% higher than its claim. In 1-3Q 2010, when coal price went up 23%, China Hong qiao dared fabricate a 33% drop in the unit cost of its self-supplied electricity.

该公司的成功不是建立在使用自供电的基础之上,因为其同行也有自备电厂。 我们使用了三种独立的方法(通过中国虹桥的数据统计细节,与其前员工交谈,并依靠行业谘询公司的数据),以表明其发电的真实成本比其声称的高出40%。 在2010年1-3季度,当煤炭价格上涨23%时,中国虹桥公司自行供电的单位成本下降了33%。

In addition to under-reporting Rmb 11.7bn of self-supplied electricity generation costs during 2010-15,China Hong qiao also bought electricity from a purported independent third party at below generation costs, thus reaping Rmb 1.9bn of subsidies.

中国虹桥除了在2010 - 15年度报告117亿元的自供电发电成本外,还在一代以下的独立第三方购买电力,获得19亿元的补贴。

China Hong qiao buys alumina, the key raw material for producing aluminum, from related parties at suchartificially low prices that its main supplier is now in serious financial woes. Such alumina subsidies have totaled Rmb 6.1bn over the years, while the under-reported costs of its internally produced alumina amounted to about Rmb 2.0bn.

中国虹桥购买了主要原材料生产铝的氧化铝,关联方价格低廉,主要供应商现在面临严重的财务困境。 这些氧化铝补贴多年来总计61亿人民币,而其内部生产的氧化铝的报告成本却低约20亿元人民币。

Predictably, China Hongqiao's effective deposit rates have consistently been less than prevailing ratesoffered by banks, suggesting that its cash and bank balances are probably less than half of claim. At theend of 2015, this represents a black hole of Rmb4.9bn on the balance sheet.

可以预见,中国虹桥的有效存款利率一直低于银行提供的现行存款利率,表明其现金和银行存款余额可能不到声称的一半。 2015年末,这是一个在资产负债表上的49亿人民币的黑洞。

Such fraudulent acts are no longer sustainable as China Hongqiao has run up a huge pile of debts(Rmb53.9bn) representing 149% of equity.

这种欺诈行为已不再具有可持续性,因为中国虹桥已经承担了大量的债务(539亿人民币),占股权的149%。

All in all, we believe China Hong qiao has hidden some Rmb 21.6bn of costs through under-reporting and related party subsidies over the years. Using assumptions advantageous to the company, we estimate that its real profitability is less than half of its claim and that the stock is worth only 40% of its current price level.

总而言之,我们认为,中国虹桥多年来通过隐报和获得相关的政党补贴隐藏了约216亿人民币的成本。 我们估计该公司实际利润率不到其声称的一半,并且股票价值仅为其当前价格水平的40%。

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员