机构:招商证券

评级:BUY

目标价:23.6港币

Cash replenished after buying out a competitor

On 2 February, Company completed the US$557mn Cardinal China acquisition. We highlight the deal’s strong strategic merits (buying out a major competitor; doubling DTP pharmacies (now China’s No.1); adding BD optionality by enhancing the imported drug agency business), as well as its reasonable valuation (18x 2018E PER vs A-share peers’ 19x)

Previously, Company raised US$402mn capital via an equity placement to fund the acquisition

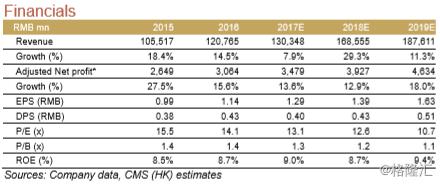

We revised down 17/18E EPS by -5%/-10% on the equity placement (5% dilution) and the slowing 3Q17 revenue growth from the two-invoice reform challenge (8% vs 10% in 1H17). SH Pharma now trades at 13x/11x 18/19E PER. Maintain BUY

Replenishing cash after buying out a major competitor

After financing the Cardinal China acquisition (the 8th largest distributor in China, with c.2% mkt share) with an equity placement, Shanghai Pharma became the second largest distributor domestically. Besides increasing its size, the deal should also complement Shanghai Pharma’s geographic footprint in Guizhou, Chongqing and Tianjin, and this should remove competition and unlock synergies in 9 provincial markets including Shanghai, Beijing and Zhejiang.

Refocusing strategy on DTP, imported drug agency

While Cardinal China’s routing business faces challenges, we think its DTP business (with 30 pharmacies) and the imported drug agency business will be a pivotal platform for SH Pharma to potentially launch more innovative and specialty drugs, which are benefiting from CFDA’s quickening reviews. Such assets should also render Shanghai Pharma a significant edge in exploring BD opportunities globally.

New TP and earnings estimates

We modelled in some further sales/earnings slowdown in 4Q17/18, which should be partly offset by combining Cardinal China - we think the operational synergy in DTP and other businesses should lift its net margin towards 0.9%-1% in 2018-19E up from the current 0.5%. Our new TP of HK$23.6 is based on SOTP (14x 2018E NOPAT for distribution, 15x for pharma). Note after the sell-down last week (in line with the sector), Company’s H share trades at the lowest quartile of the trading band, with 9%-25% discount to H share peers.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员