机构:招商证券

目标价:4.03港币

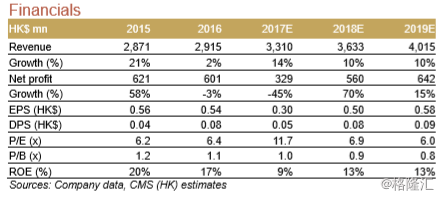

We expect FY18E NP to recover with 70% YoY (vs -45% YoY in FY17E) following Kashuo impairment and R&D increase in FY17E

2018E outlook: share gain in LACIS (mPOS)/ USCA (multilane/ ECR)/ APAC (Japan/India), offsetting continued China weakness

Trimmed FY17/18E/19E EPS by 36%/4%/1% for R&D/ impairment; Maintain NEUTRAL with new TP HK$4.03 (on lowered 8x FY18E P/E)

Focus on overseas expansion despite domestic weakness

We forecast solid FY17E/18E revenue growth of 14%/10% YoY driven by continued overseas expansion in LACIS/USCA/EMEA/APAC while China revenue will remain soft on intense competition. Excluding Kashou impairment, FY17E net profit will decline 21% YoY given increased R&D expenses for smart POS in China. We believe investment will start to bear fruit in 2018, as mgmt. indicated China UnionPAY began to provide RMB400 subsidy for smart POS since 2H17. We trimmed FY17E/18E/ 19E EPS by 36%/4%/1% to reflect R&D investment, Kashuo impairment offsetting stronger revenue from EMEA/ LACIS/ APAC.

Robust mPOS sales in LACIS; Smart POS to begin from USCA

By region, we expect LACIS to deliver 80%/15% YoY sales growth in FY17E/18E due to strong trad-POS/ mPOS sales with Pagseguro and Cielo. For EMEA, we expect better revenue growth of 5% YoY in FY17E (vs. guidance 0% YoY) given share gain on Ingenico’s weakness after Bambora’s acquisition. For China, we believe weakness will stabilise with 5% YoY decline in FY18E (vs -25% YoY in FY17E) given competition, while smart POS should ramp in FY18E. As for APAC, we expect 25%/ 15% YoY growth in FY17E/18E driven by M&A in South Korea and new subsidiaries in Japan/India, and FY20E Olympics in Japan. In USCA, we expect continued client/order wins with smart terminal e-series will drive 40%/+45% YoY sales growth in FY17E/18E.

Lack of catalysts in near term; Maintain NEUTRAL

Despite PAX’s solid global share gains, we believe current valuation of 6.9x is fair given lack of near-term catalysts and slower revenue growth in FY18/19E. We maintain Neutral and lowered TP to HK$4.03 based on 8x FY18E P/E (vs prev 10x on down-cycle P/E with lower visibility). We recommend keeping an eye on overseas expansion progress and new product (smart terminals) performance in USCA/ China.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员