机构:兴业证券

评级:增持

目标价:50.21港元

HEC reported significant earnings growth for H217.

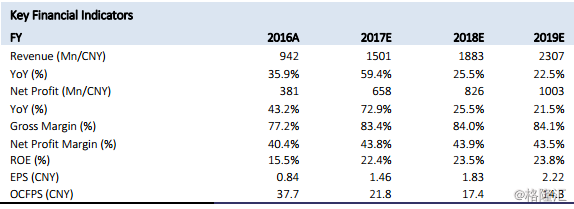

Company’s net profit attributable to shareholders shall increase by no less than 70% for whole 2017.Given the 40.4% profit growth of H117, we expect company’s profit growth to exceed 110% for thesecond half of 2017. We believe the booming earnings growth mainly attributed to three factors: 1)the influenza outbreak in H217 boosted sales of its main product, Kewei (Oseltamivir Phosphate Granules); 2) more sales staff were recruited and the efficiency of promotion activities kept improving; 3) economies of scale and falling costs of raw materials drove up company’s gross margin.

HEC Pharmaceutical's core product, Kewei, posted surging sales.

We attribute HEC’s explosive earnings growth of 2017 to surging sales of Kewei. The annual sales growth may clock in higher than 70% for 2017. Moderate growth in H117 was due to structural reform of sales team and company quitting bid in several provinces.The influenza outbreak of 2017 became much more severe in H217, fueling surging demand for Kewei (since Kewei was the main chemical drug for treatment). At the same time, fallout of company’s sales team reform mitigated gradually and company's sales team continued expanding.The two factors brought company’s sales volume back to a fast upward track in H217. Weaving distribution network across China is gradually gaining HEC access to markets other thanGuangdong Province and building new headroom for Kewei. Considering that the current flu may lastuntil H118, and that company’s nationwide distribution channel shall bring new momentum, weexpect the sales of Kewei-series to grow by over 25% in 2018, and by over 20% in 2019

Potential risks: the sales of Kewei may fail to meet expectation; influenza morbidity may be volatile;products under research may be promoted to market later than expected.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员