机构:交银国际

Strong momentum in gas sales sustained in Jan-Mar 2018: We maintain our positive stance on CGH’s growth prospect after a recent update with management. We expect CGH to have maintained strong momentum in retail gas sales during Jan-Mar this year with ~35% YoY growth after posting ~37% YoY growth during 10MFY18 period. Therefore, we are comfortable to uphold our FY18 forecast of ~36% YoY growth in retail gas sales and 53% YoY growth in total gas sales. Management maintained the guidance of 25% YoY growth in retail gas sales for FY19E and FY20E. Regarding dollar margin, we maintain our forecasts of RMB0.62/m3 for 2HFY18 and RMB0.63/m3 for full-year FY18.

New connections to stay robust in FY19E: We estimate CGH to complete 1.1m rural new connections in FY18, thanks to its strong execution of coal-to-gas conversion campaign in 2017. Management explained that the rural new connections were mainly in Hebei and Tianjin in FY18E. Together with 2.7m from urban areas, total new residential connections should reach 3.8m in FY18E. Management maintained FY19E rural area connection target of 2.0m, which will further extend from Hebei and Tianjin to Shandong, Shanxi and Henan.

Investment in gas storage facilities not likely to speed up in short term: Meanwhile, management guided for at least HK$6.5bn capex to be spent in FY19E. Investment in rural coal-to-gas conversion and urban projects will be split into around 1:1. Currently, management stated that CGH does not have plans to speed up investment in gas storage facilities, before the company could see satisfactory investment returns.

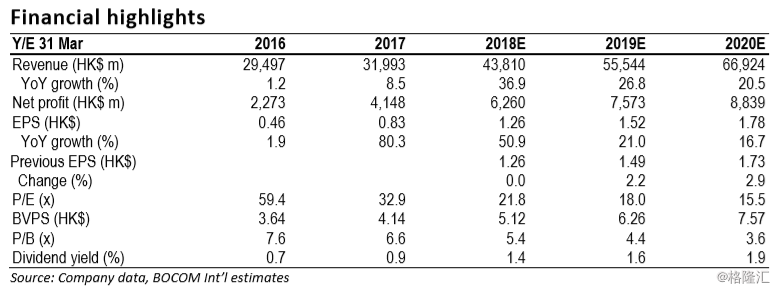

Valuation justified on higher growth; maintain Buy: After fine-tuning our model, we lift our FY19/20E earnings by 2.2%/2.9% to factor in RMB appreciation against HKD and more stable dollar margin forecasts after FY20E. We also revise up our DCF-based TP to HK$31.00 (from HK$28.00). In our view, CGH’s highest gas sales and net profit growth could justify its higher valuation at 18x forward P/E vs. ENN (2688 HK) and CR Gas (1193 HK) (trading at ~14x/16x forward P/E). Maintain Buy.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员