机构:银河证券

评级:HOLD

目标价:33.6 (+7.87%) 港元

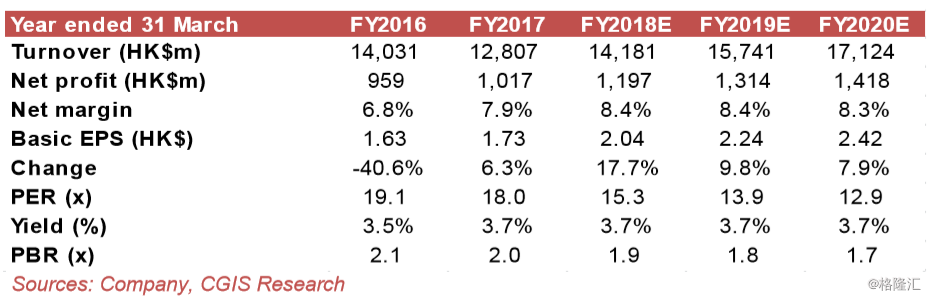

The Q4 FY2018 (Jan-Mar 2018) operating figures reported by Luk Fook show a mixed picture. For the HK/Macau region, the Company is a beneficiary of Hong Kong’s retail market recovery. SSSG during the period was +18%, driven by both gold products and gem set jewellery. Luk Fook also benefited from more mainland Chinese tourist arrivals in HK. The growth was in line with the industry average. However, mainland China was still somewhat weak, as SSSG was mildly negative for two consecutive quarters. While Luk Fook attributed this to the high base effect, we believe it continued to face keen competition from its peers. For March and early-April, its Hong Kong/Macau business continued to improve, and we expect the momentum to continue, as we expect consumers to buy more gold products for inflation protection. We expect Luk Fook to continue to benefit from consumption upgrades and business expansion in mainland China, but it will take time for the Company to prove itself as an obvious market gainer in the current cycle, especially in China. We maintain our HOLD rating, as we believe another re-rating in the near term is unlikely. Overall, we slightly lift our EPS forecast for FY19E/20E by 4.1%/4.3% to HK$2.04/HK$2.24 to reflect the positive outlook for its HK/Macau operations, and lift our TP to HK$33.6, based on 15x FY19E PER (its average level).

Investment Highlights

Overall SSSG Supported by Strong HK/Macau Performance. Overall SSSG for Luk Fook in Q4 FY2018 was +16%, attributable to strong HK/Macau SSSG of +18%, driven by both gold and gem set jewellery sales (both recorded SSSG of +19%). The Company suggested the good performance was driven by increasing tourist arrivals from mainland China, and noted that March was better than both Jan and Feb, suggesting a proven recovery in the local retail market.

Mainland China: Still under Pressure. The performance in mainland China continued to be under pressure for two consecutive quarters. Luk Fook reported –2% SSSG in JanMar 2018, although the March performance turned better. Management attributed this to (1) the high base effect in FY17, resulting in a weaker growth rate for FY18, (2) keen competition, especially from some of its peers, and (3) likely cannibalization from the HK/ Macau region. On the bright side, store expansion was better than expected. With franchisees opening more stores than originally expected, the total number of stores in mainland China reached 1,561 (157 self-operated and 1,404 licensed) by the end of March. The Company is also considering revising upwards its store opening plan for FY19E.

Yet to Show Signs of Solid Market Outperformance. From a top-down perspective, Luk Fook should be a beneficiary of HK’s retail recovery and consumption upgrades in China. It should also benefit from gold product demand, triggered by inflation concerns. However, we have become more hesitant about expecting Luk Fook to become an outperformer in the current cycle. Apart from keen competition from Chow Tai Fook [1929.HK; BUY], we are more wary of competition from local brands targeting the mass market. For example, Chow Tai Seng [002867.CH; NR] posted strong earnings growth thanks to its franchising model. This could pose a threat to Luk Fook, which has a similar business model.

Another near term re-rating unlikely. Maintain HOLD. We slightly lift our EPS forecast for FY19E/20E by 4.1%/4.3% to HK$2.04/HK$2.24, and our latest TP to HK$33.6, based on 15x FY19E PER. We believe the recent rally already reflects Luk Fook’s good performance in Hong Kong. More catalysts, especially evidence of better performance in mainland China, are needed for another re-rating.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员