机构:中信建投

评级:BUY

目标价:9.0 港元

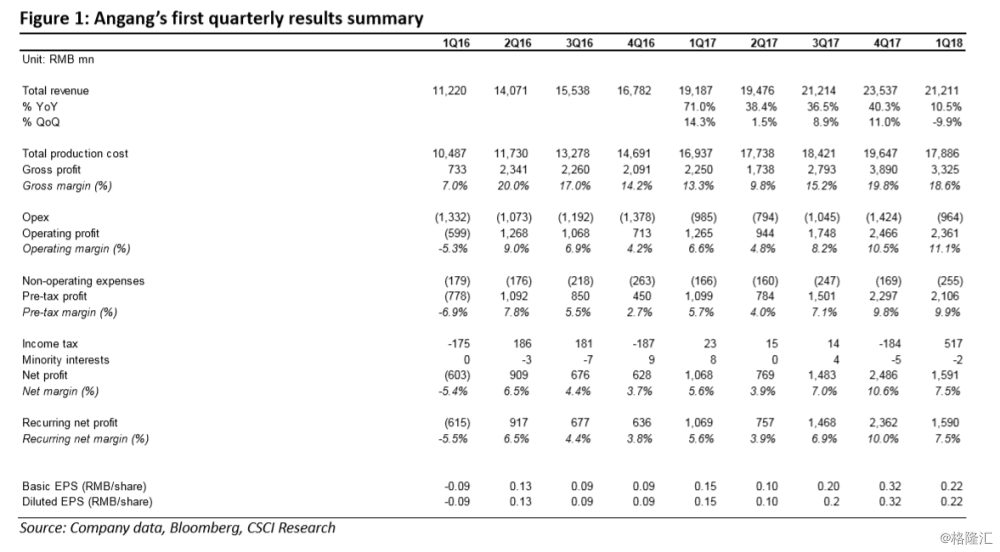

1Q18 results reaffirm strong uptrend in earnings remains intact. Net profit increased 48.8% YoY, driven by higher steel product prices and substantial margin expansion. Despite a traditional low season, the company has seen first quarter net profits at the highest level since 1Q08. Based on our calculation, the company’s gross dollar margin has come in at RMB666/ton in the period, on a 10% YoY hike in its unit product selling prices and only a 6% increase in production cost.

Market concern over U.S. tariffs on Chinese steel likely overdone. As the price spread between steel products and raw materials has retreated from the Jan year-high level whilst the YTD average has remained higher than the full-year average in 2017, we believe the market is over concerned about the potential impact to be brought about by the U.S. steel tariffs given that the U.S. does not make up a significant portion of China’s steel imports. According to China Customs data, China’s total net export to steel products consumption ratio has decreased during the first three months of this year. As such, on assumption that downstream consumption would continue to grow in the coming quarter, we believe the impact from the trade tariffs would be relatively limited. Moreover, as the Chinese government has planned to shut down 30mn tons of obsolete capacity, we expect the demand-supply dynamics of the domestic steel industry to improve further amid the ongoing industry consolidation. According to official data, China’s crude steel production has increased during first three months of 2018, whereas China’s social steel inventory has resumed on a downtrend since mid-Mar, which signals an improving market, in our view.

Appealing earnings recovery story. We have revised up our FY18E earnings estimate on the back of management’s latest guidance. Based on our forecast that Angang’s ROE will recover to c.11.7% in2018, which is significantly higher than only 5.5% in 2008, we have pegged our price target to our estimated per share book value. Accordingly, our PT has been raised to HKD9.0 (from HKD8.5), equivalent to 1.0x FY18E PBR, which we deem undemanding. Thus, maintain BUY.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员