机构:中金公司

评级:HOLD

目标价:4.29港元

2017 results beat expectation

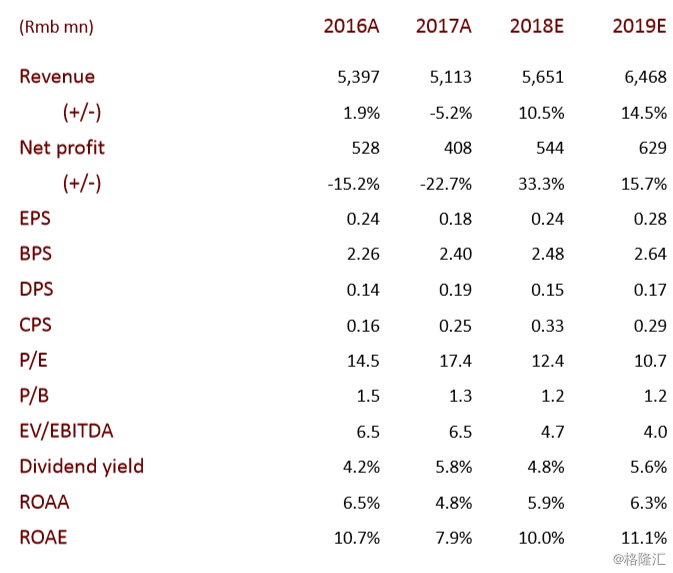

Xtep International announced 2017 results: Revenue slipped 5.2% to Rmb5,113mn; net profit of Rmb408mn (Rmb0.18/share) was down 22.7%, less than the 30% we originally forecast and the 25–35% the company previously warned of. Net of a Rmb121mn one-off loss due to product repurchases, net profit edged up 0.2%. Including a special dividend of HK$0.10, Xtep paid a DPS of HK$0.23 (for a yield of 6%).

Retail overview: E-business contributed over 20% of sales, while offline stores totaled around 6,000 (down 12% from around 6,800 at end-2016 due to channel adjustments), and 250 of these are Xtep Kids stores. Store efficiency improved on increases in stores directly operated by distributors (accounting for more than 60% of POS) and more renovated stores. SSSG in 2017 was in the mid-single digits. Retail inventory remained below the industry average at four months. Gross margin rose 0.7ppt to 43.9%. SD&A expense ratio rose 4.8ppt on higher A&P and R&D costs, product buybacks and inventory write-downs.

Trends to watch

SSSG continued to improve in January–February (it was in the high single digits in 4Q17). We expect channel restocking and positive sales growth for the whole year. Xtep intends to launch footwear of international standards this year thanks to extensive R&D efforts.

Earnings forecast

We raise our 2018 and 2019 EPS forecasts by 19.4% and 20.6% to Rmb0.24 and Rmb0.28 (implying growth of 33.3% and 15.7%).

Valuation and recommendation

The stock is trading at 12x 2018e and 11x 2019e P/E. We maintain HOLD but raise our target 24.3% to HK$4.29 (based on 12x 2019e P/E and offering 11.8% upside). We believe a strategic transformation in 2017 will drive long-term organic growth despite short-term pains, but Xtep should be cautious in initiating a multi-brand strategy.

Risks

Retail performance recovers more slowly than expected.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员