机构:德意志银行

评级:Buy

目标价: 3.20 港元

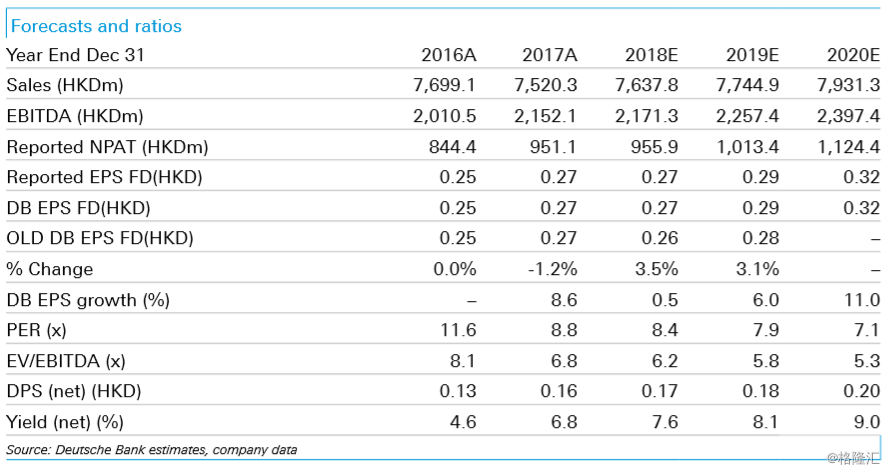

Tough year in Macau, but the firm holds up 2017 net profit rose 4% to HK$896m, and underlying profit was approximately flat, which is a good result considering conditions cycled down. Management seems confident that the upcycle will follow, so upped DPS 21% to HK$0.16 and suggested payout will be held and DPS will be flat to rising ahead, which suggests its sector leading 7% dividend yield will hold or increase.

During 2017, the Macau business was under pressure from the December 2016 broadband price cut (ARPU down 16%), the ongoing fixed line decline, and from enterprise revenue dropping 25% as projects got delayed. If that was not enough, there was the worst storm in five decades, which left Macau underwater, caused power cuts and created a transport shut down. Management believes these events will not be repeated in 2018, setting it up for a pick-up. The other winds in Macau, the political ones, that led to broadband price cuts, also appear to have abated. Network upgrades led to high rankings in world network tests, and good performance in the storm. Add to that Macau's desire to succeed as a smart city, and it appears CTM is aligned with the government again. This is encouraging, and smart city will be an opportunity.

Beyond Macau, the company is developing an interesting story in value-added services. Its managed services business, CPC, is growing at double-digit rates, and is set up for Belt-and-Road demand as Chinese firms expand. The SMS business is now taking off again, thanks to apps, Datamall is growing rapidly, and the IDC business is a driver. We notice significant management energy for these businesses. On top of this, the company is looking to degear in the coming oneto-two years, which we think is healthy. The firm remains too much of a niche play for many, but is emerging as a relatively interesting story again, with very attractive valuation multiples in our view. BUY.

Company busy, as it deals with sector change for better and worse

The Macau core businesses of mobile, fixed line and internet services when combined saw flat service revenues. But as noted above, a better cycle seems at hand Enterprise revenue rose 14%, due to the acquisition of Linx and Acclivis (Pacific Internet). While revenues from CPC grew by around 15%, this was offset by contraction in Macau, as resort launches cycled off. Further growth looks likely as China’s crackdown on illegal VPNs should reduce competition for licensed

providers like CPC. Management appeared very upbeat about opportunities to benefit from Chinese companies expanding out of China, and Eurasian companies expanding into East Asia.

International business was flat YoY, with the company seeming to have transitioned through the painful voice contraction of recent years. Datamall helped, as did SMS, which turned upwards, with revenue gaining 32%, as appbased SMS took off. It was suggested that Datamall is hitting a new growth phase helped by a strong new partnership in China, and a move beyond the B2B2C model.

Generally, the company appears busy in rolling out new services to take advantage of its 130 points of presence and communications platform as a service to roll out new calling and managed services globally.

Valuation and risks Our DCF-based TP is set using a WACC of 6.8% (risk-free rate 2.4%, beta 1.0x, risk premium 5%) and terminal growth of 1%. Key downside risks: 1) Rising interest rates, 2) increased competition in Macau, 3) Low ROI M&A

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员