机构:申万宏源

目标价:15.6港币

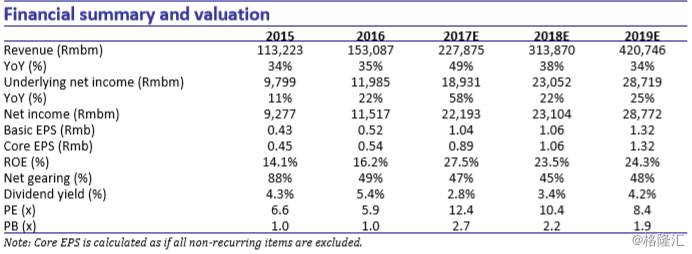

Guangdong-based private developer Country Garden guided full-year 2017 net profit growth of 90%-plus YoY, citing growth in booked revenue and improved gross margin. The profit alert is not unexpected, but, given the recent decline in share price, we see potential for a near-term rally in response. Our most recent forecast of underlying net income of Rmb18.3bn in 17E (+53% YoY) factors in the firm’s new construction technology, and we raise our 17E net profit attributable to shareholders forecast by 20% to Rmb22.2bn to account for the surprise from one-off items. We lift our diluted EPS forecast from Rmb0.86 to Rmb1.04 (+100% YoY) and from Rmb1.02 to Rmb1.03 in 18E (-0.1% YoY) but maintain our forecast at Rmb1.28 in 19E (+24.3% YoY). We maintain our target price at HK$15.60 and upgrade our rating from Hold to Outperform.

Robust contract sales. Country Garden recorded contract sales of Rmb551bn in 2017 (+78% YoY; vs sector average of +58% YoY), becoming the largest mainland developer by sales. Sales by gross floor area (GFA) hit 61msqm in 2017 (+62% YoY) and the average selling price (ASP) was Rmb9,080/sqm (+10% YoY), while the interest attributable to the company was down to c.70% in 2017, vs c.76% in 2016. Street consensus of the company’s 2018 sales target is Rmb700bn (+27% YoY), while in the first month this year the firm reported contract sales at Rmb69bn (+42% YoY) following a conservative disclosure of Rmb16.5bn in the last month of 2017.

Heavy land investment. The firm added 875 projects in 2017 with attributable GFA at 101msqm and average floor cost at Rmb3,225/sqm. Land investment surged by 155% YoY from 2016, with the ratio of expenditure to sales up from 55% in 2016 to 85% in 2017. We calculate total land reserves attributable to the firm of 175msqm at end-2017 with a cost at Rmb2,523/sqm (vs Rmb1,557/sqm at end-2016), sufficient for three years’ development, but land cost as percentage of ASP rose to 28% (vs c.19% in 2016). In addition, with tier-1 and tier-2 cities accounting for 14% of land reserves, tier-3 cities and lower-tier cities contribute 21% and 65%.

Capital raising and recent drop. The company raised a total of c.HK$23bn in January this year through an issue of 460m new shares (2.2% of existing share capital) at HK$17.13/shr and issuing HK$15.6bn in a one-year convertible bond with a conversion price at HK$20.56/shr (3.6% of existing shares should it be fully converted). The stock price has been under pressure since then and further corrected by more than 20% amid the recent market downturn, retreating 30% from its mid-January peak. Currently the firm is trading at 12.4x 17E PE and 2.7x 17E PB, 10.4x 18E PE and 2.2x 18E PB, or 9% discount to our net asset value (NAV) estimate at HK$14.22.

Upgrade to Outperform. Country Garden enjoyed a sharp re-rating in 2017 with return by 248%, but YTD recorded a loss of c.12%. With two-thirds of its pipeline in lower-tier cities and limited prospects for growth in those markets amid ongoing property cooling measures and credit tightening, we remain cautious over the company’s sales outlook this year. However, we remain positive on its execution capability and high earnings visibility in 2018-19E. We maintain our target valuation at a 10% premium to NAV and thus our target price of HK$15.60. With 18.7% upside, we upgrade our recommendation from Hold to Outperform.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员