评级:维持

目标价:3.80港元

Nov contract sales revenue up 30% YoY The company’s Nov contract sales revenuerose 30% YoY to HK$2.6bn, and GFA sold increased by 14% YoY to 0.23m sqm.11M17 contract sales revenue was up 57% YoY to HK$34bn, and GFA sold increasedby 27% YoY to 3.2m sqm.

Focus on third/fourth-tier cities a key concern As of June 30, 2017, the companyhad a total land bank of around 16.6m sqm, mainly in 20 third and fourth-tier cities inChina. Third/fourth-tier cities were the main growth drivers of China’s property marketduring 1H17. Given tightening monetary supply, a relatively high sales base in 2016 and1H17, and the lack of consistent owner-occupier housing demand, we believe demandin third and fourth-tier cities may not be sustainable.

Share price dropped 43% during the 2014 down-cycle In 2014, due to tighteningpolicies, primary residential property sales revenue in China dropped 9% YoY toRmb10.5trn, while the Hang Seng Index rose 1% to 23,605. The company’s contractsales revenue increased by 5% YoY to HK$18bn during the year, and revenue dropped12% YoY to HK$14bn (97% of revenue was from third-tier cities). Gross margin droppedby 900bps YoY to 24%, and net earnings declined by 60% YoY to HK$1.3bn. Due to itsfocus on third-tier cities and its poor financial results, its share price dropped fromHK$7.30 (1.4x 2014 NBV) to HK$4.00 (0.7x2014 NBV) by the end of the year.

Proposed new share issue may dilute 2018 EPS by 50% The company is set to issue1.14bn new shares to controlling shareholder COLI (688 HK, Buy). According to ourcalculations, the issuance will dilute total shares and 2018 EPS by 50%. COLI currentlyhas a 38% stake, but the issuance, set to be completed by Jan 2018, will see this rise to57%.

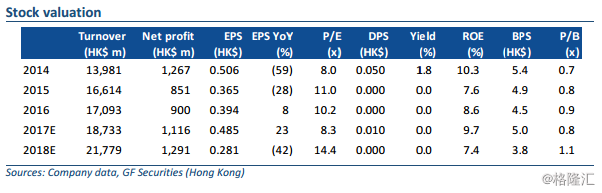

We forecast EPS will drop by 42% in 2018 As of June 30, 2017, the company hadsold but un-booked GFA of 3.0m sqm. We forecast the company will book GFA of 2.2msqm/2.5m sqm in 2017/18 respectively, at ASPs of HK$8,400/HK$8,600. We estimateEPS will rise by 23% YoY in 2017 to HK$0.49. To factor in the dilution effect from thenew share issue, we forecast EPS will drop by 42% YoY to HK$0.28.

Expensive valuation; maintain Underperform According to our calculations, the stockis trading at 14.4x 2018E P/E, or 1.0x 2018E P/B, after factoring in the dilution effect.Given the uncertainty in China’s third/fourth-tier cities and the EPS dilution, we see itscurrent valuation as expensive. We maintain our Underperform rating and our targetprice of HK$3.80, equal to 1.0x 2018E P/B, in line with its historical trading range.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员