Key takeaways

Key takeaways

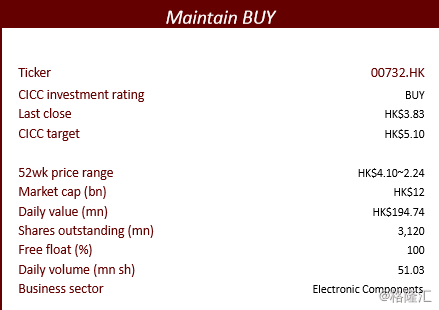

We visited Truly Shanwei’s fab on December 7 and reaffirmed two long-term growth drivers for parent Truly International Holdings—we expect sales of 3D sensing modules to take off from 3Q18 and higher-margin automotive panels to serve as a cash cow. Meanwhile, we believe Truly International’s market cap will rise once Shanwei lists on the Shenzhen Stock Exchange at a likely valuation premium. We reiterate BUY on Truly International with a target price of HKD5.10.

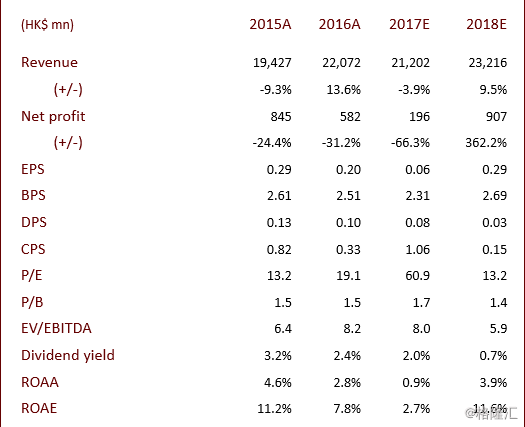

3D sensing modules to contribute from 3Q18. We expect Shanwei’s CCM sales to soar 44.2% in 2018 and 25.0% in 2019 as 3D sensing modules start contributing from 3Q18. The company has developed 3D structured light and TOF solutions, and we believe it has established cooperative agreements with global algorithm and optics suppliers on the former. With 3D sensing module shipments set to take off and commanding a significant ASP premium, we expect the CCM segment to become the key growth driver in Truly International’s smartphone-related business going forward.

Automotive panels to contribute more sales and boost margin. Truly International expects mass production at phase 1 of its Shanwei fab to begin in 1Q18, with full capacity of 65,000 panels/month. The firm was the sixth largest automotive panel maker in the world with a market share of 6.4% in 2016, and we think it will increase this to 12.6% in 2019 by leveraging its distribution channels and strong relationships with automobile OEMs and tier-one suppliers to gain presence. Automotive panels command gross margins of around 20.0%, so Truly International’s overall gross margin should improve as the products contribute more sales.

Recommendation

Reflecting expectations of a boom in the 3D sensing module business and a comparatively stagnant remaining smartphone-related business, we fine-tune our 2018 and 2019 revenue forecasts (up 1.8% and down 4.2% respectively), while raising our 2018 net profit estimate by 25.1% and lowering our 2019 forecast by 14.7%. We derive our target price of HKD5.10 for Truly International by a sum-of-the-parts method, valuing Shanwei at the A-share display industry average 2018e P/E of 25.0x and other subsidiaries at 13.0x.

Risks Efforts to acquire automotive display clients disappoint

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员