评级:买入

目标价:9.72港元

Investment positives

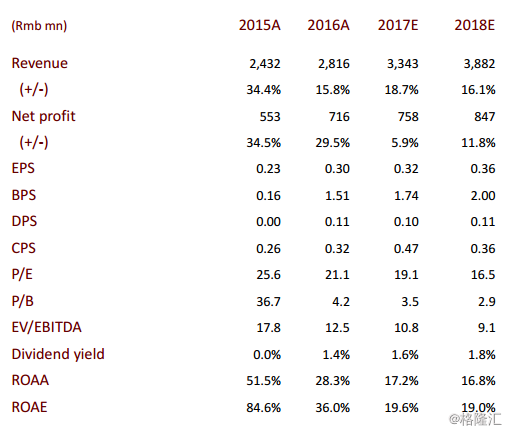

We initiate coverage with a BUY rating and a target price of HK$9.72based on 23.4x 2018e P/E—lower than the average for Hong Kongstaples and global peers using chain store business models. Given thelong-term growth visibility, the current 16.5x 2018e P/E presents agood buying opportunity, in our view.

Why a BUY rating?

Abundant demand potential. We expect potential demand forexisting products at 4.3x of 2017e sales in self-operated stores(Rmb2.78bn). Assuming the company meets all potential demand in10 years, we expect the sales CAGR of self-operated stores to reach15.6% over 2017–2027 in our base case.

Margin correction does not reflect weakening consumption. Themargin correction is more a result of the company's attempts toexpand membership, foster robust growth of online demand and amismatch between the growth pattern of rental cost and averagesales per store. Excluding member discounts, ASP and gross marginshould remain stable. We also expect the ratios of online expensesand rentals to sales to fall after peaking in 2020 and 2022.

Watch moves to extend brand and improve margin prospects. Newproduct development and moves to extend derivative products mayaccelerate, increasing sales per store and improving margin. Oursensitivity analysis shows that each 5% increase in the sales ofself-operated stores will lift EBIT margin to about 1%.

How do we differ from the market? Our quantitative study suggestssignificant potential demand for existing products. We also seepotentially higher value and believe the self-operated store platformis a realistic approach. We expect profit margins to turn around.

Potential catalysts: Fast growth in store numbers & sales; re-launchof crayfish product in January and refocus on vacuum-packedproducts; development of derivative products in 2018.

Financials and valuation

Our EPS forecast is Rmb0.32 for 2017 and Rmb1.33 for 2027, a CAGRof 15.4%. Under a base-case scenario, net margin will rebound afterbottoming out (19.5%) in 2021. Potential long-term growth justifies aDCF pricing model, in our view, yielding an end-2018 TP of HK$9.72.

Risks

Poor performance of new products may fail to reverse margindecline; pace of new store opening and SSSG miss expectations.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员